Menu

Private Label Beverages: Costs, MOQs, and Timelines Explained

Author

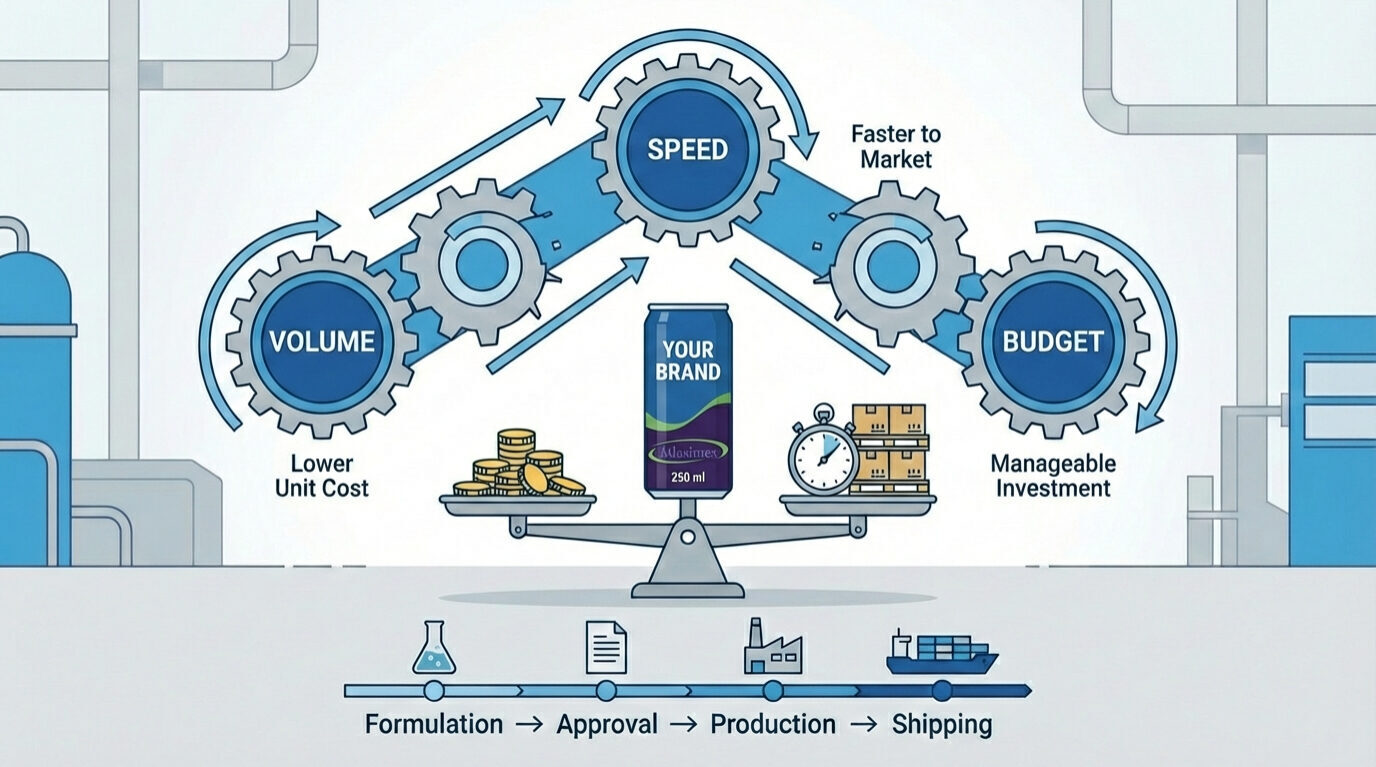

The Economics of Production: Balancing Volume, Speed, and Budget

For importers and distributors entering the private label market, the production process often feels like a "black box" of hidden costs and vague schedules. However, a profitable beverage brand is built on predictable economics. Understanding the levers that impact your bottom line—specifically the interplay between Minimum Order Quantities (MOQs) and formulation complexity—is essential for calculating a realistic Return on Investment (ROI).

At Atlasimex, we believe in radical transparency. Whether you are launching a value-tier energy drink or a premium functional beverage, three primary factors will dictate your initial investment:

- Volume vs. Unit Cost: The fundamental rule of manufacturing. Higher MOQs (Minimum Order Quantities) allow us to amortize setup and changeover costs across more units, significantly lowering the price per can.

- Ingredient Sourcing: A standard energy formulation is cost-effective and fast to produce. Custom formulations with exotic extracts (like natural caffeine or adaptogens) require longer lead times and higher raw material costs.

- Packaging Customization: Standard 250ml cans are the industry workhorse. Opting for specialized formats, like sleek 330ml cans or custom tactile varnishes, adds to both the timeline and the capital requirement.

One of the biggest hurdles for new brands is the MOQ. Industry standards often demand hundreds of thousands of units for a first run, tying up capital in inventory that hasn't been market-tested. Atlasimex takes a different approach. We offer flexible MOQs that allow our partners to validate their concept in the market without over-committing. We scale with you—starting with manageable runs to test consumer reaction, then ramping up to full 20ft or 40ft container loads as demand solidifies.

Time is money, especially in international trade. A typical timeline—from the moment a contract is signed to the "Ex-Works" readiness—involves several critical gates: lab formulation, regulatory approval (compliance with your local import laws), label printing, and finally, filling. Our logistics team specializes in container optimization, ensuring that whether you are shipping Euro pallets (120x80cm) or loose-loaded containers, every square inch of space is utilized to minimize your landed cost per unit.

Tags

- Supply Chain

- Manufacturing Costs

- Logistics

- Business Strategy

Share

Join our newsletter

Email address: Subscribe